5 Smart Ways to Save Money on Your Insurance Premiums This Year

In an ever-evolving economic landscape, managing household expenses and business costs is more crucial than ever. For many, insurance premiums represent a substantial recurring outflow. While insurance is an indispensable financial safeguard for your most valuable assets – your home, your car, your health, your business, and even your family’s future – the cost doesn’t have to be a fixed burden. There are intelligent, proactive strategies you can employ to significantly reduce your premiums without compromising on the vital protection you need.

At TheBestInsurance.co, our core mission is to empower you with knowledge and tools to find the best rates effortlessly. This guide goes beyond simply comparing quotes; it delves into the strategic aspects of insurance pricing, revealing how you can influence your premiums and unlock substantial savings. Let’s explore five powerful ways to cut down your insurance costs this year.

1. Bundle Your Policies: The Undeniable Power of Multi-Policy Discounts

One of the most straightforward and effective methods to secure significant savings on your total insurance outlay is by consolidating multiple policies under a single insurer. This practice, commonly known as “bundling,” leverages the power of loyalty, which insurance companies are often eager to reward.

Why Insurers Offer Bundling Discounts:

- Reduced Administrative Costs: It’s more cost-effective for an insurer to manage one client with multiple policies than several clients with single policies. These savings are often passed on to you.

- Increased Customer Loyalty: When you have multiple policies with one company, you’re less likely to switch, creating a stable customer base for the insurer.

- Simplified Management: For you, it means fewer bills, fewer agents to deal with, and a consolidated view of your coverage.

Common Bundling Combinations:

- Auto + Home Insurance: This is the most popular and often yields the largest savings, sometimes ranging from 10% to 25% or more on your combined premiums.

- Auto + Renters Insurance: If you rent, bundling your auto policy with renters insurance is a smart, affordable move.

- Auto + Life Insurance: Some insurers offer discounts when you hold both an auto and a life insurance policy with them.

- Home + Life Insurance: Another less common but still viable bundling option.

- Business Owners Policy (BOP) + Commercial Auto: For businesses, combining general liability and property insurance with commercial auto can lead to significant savings.

Actionable Tip: When you utilize TheBestInsurance.co’s platform to compare quotes, always indicate all the types of insurance you require. Our system is designed to identify and highlight providers who offer attractive bundling discounts, allowing you to see your potential combined savings upfront. Don’t assume your current separate policies are the most cost-effective solution.

2. Increase Your Deductibles (Wisely): Finding Your Optimal Balance of Risk and Reward

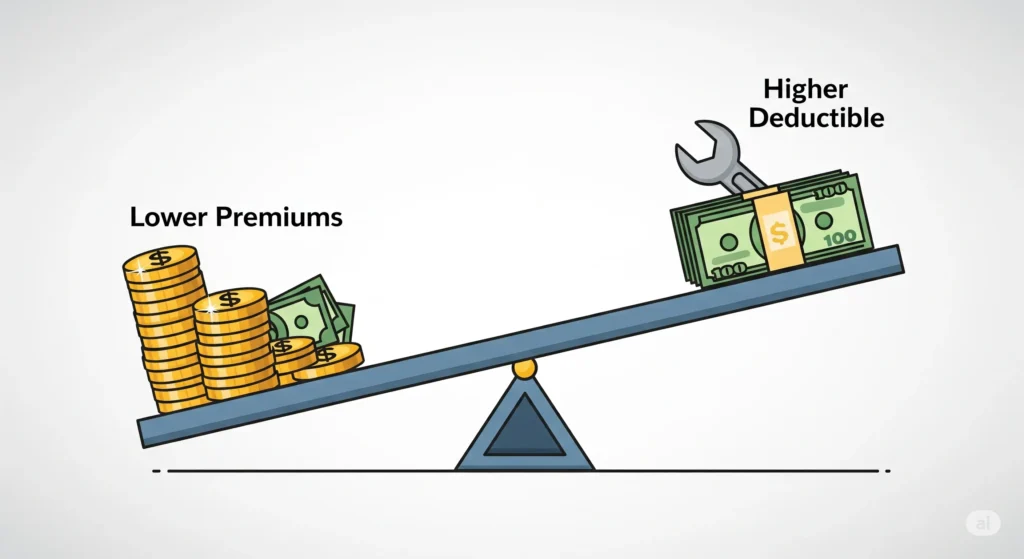

Your insurance deductible is the predetermined amount of money you agree to pay out-of-pocket for a covered loss before your insurance coverage begins to pay the remainder of the claim. It acts as a shared responsibility between you and your insurer. A fundamental principle in insurance pricing is: the more risk you agree to assume (by having a higher deductible), the less risk the insurer bears, which typically translates into lower regular premiums for you.

Understanding the Deductible Dynamic:

- Lower Deductible (e.g., $250 – $500): You pay less if you file a claim, but your monthly or annual premiums will be higher. This option provides a stronger safety net in case of an incident, as your out-of-pocket expense is minimal. It’s suitable if you prefer predictable, lower costs during an unexpected event.

- Higher Deductible (e.g., $1,000 – $2,500+): You pay more if you file a claim, but your regular premiums will be noticeably lower. This strategy is ideal if you have a robust emergency fund readily available to cover potential unexpected costs and prefer lower recurring insurance expenses. It’s a calculated risk that often leads to significant long-term savings.

When to Strategically Increase Your Deductible:

- Robust Emergency Fund: You possess a healthy savings account (ideally 3-6 months of living expenses, or specifically enough to cover your chosen deductible) that can comfortably absorb the higher deductible amount without causing financial strain.

- Low Claim History: For auto insurance, you maintain a consistent, clean driving record with few or no accidents. For home insurance, your property is well-maintained, and you don’t anticipate frequent minor claims.

- Seeking Immediate Premium Reduction: A higher deductible offers one of the most direct ways to see an immediate and tangible reduction in your ongoing premium costs.

Types of Deductibles to Consider:

- Per Occurrence: Most common for auto and home, applies to each claim.

- Aggregate Deductible: More common in commercial policies, where a single deductible applies to all covered losses within a policy period.

Cautionary Note: It is absolutely critical never to choose a deductible higher than what you can realistically afford to pay out-of-pocket if a claim occurs. The goal is to save on premiums, not to inadvertently put yourself in a precarious financial position during an emergency. Always weigh the potential premium savings against your immediate financial liquidity.

3. Improve Your Home & Auto Security: How Deterrence Turns into Discounts

Insurers are in the business of risk assessment. The less likely you are to file a claim due to theft, damage, or fire, the less risk they assume, and consequently, the more inclined they are to offer you discounts. Investing in robust security features for your home and vehicle isn’t just about peace of mind; it’s a smart financial decision that can lead to noticeable reductions in your insurance premiums.

Security Enhancements for Your Home Insurance:

- Monitored Alarm Systems: Professionally installed and monitored burglar and fire alarm systems often yield the most significant discounts. Some insurers might even offer further reductions for central station monitoring.

- Deadbolts & Smart Locks: High-quality, multi-point deadbolts on all exterior doors are a basic yet effective security measure that can be recognized. Smart locks add convenience and often provide logging features.

- Smoke, Carbon Monoxide, and Water Leak Detectors: Beyond standard smoke detectors, interconnected systems, carbon monoxide alarms, and smart water leak detectors (which can prevent costly water damage claims) are highly valued by insurers.

- Fire Extinguishers & Sprinkler Systems: Having accessible fire extinguishers is a simple safety measure. Comprehensive fire sprinkler systems can significantly reduce fire damage risk and earn substantial discounts.

- Reinforced Roofing & Storm Shutters: In areas prone to severe weather, features like impact-resistant roofing materials or permanent storm shutters can lead to discounts.

- Smart Home Technology: Devices that can remotely monitor your home’s security, detect frozen pipes, or regulate temperature can sometimes qualify for discounts.

Security Enhancements for Your Auto Insurance:

- Anti-Theft Devices:

- Active Devices: Require action (e.g., steering wheel locks, kill switches, car alarms).

- Passive Devices: Work automatically (e.g., engine immobilizers, vehicle tracking systems like LoJack). The more advanced the system, the greater the potential discount.

- Vehicle Tracking Systems: GPS-based tracking systems can help recover stolen vehicles, making them attractive for insurers.

- Dash Cams: While not always a direct discount, having a dash cam can provide crucial evidence in an accident, potentially speeding up claims processing and even proving non-fault, which indirectly helps maintain lower rates.

- Telematics Programs (Usage-Based Insurance): Many insurers offer programs where a small device plugs into your car’s diagnostic port (or an app on your phone) to track driving habits like mileage, speed, braking, and time of day. Safe drivers, especially those with lower mileage, can earn substantial discounts. While offering savings, be mindful of privacy considerations.

Actionable Tip: Always inform your current insurer or any new insurer about the security features you have. They might not automatically apply discounts unless you specifically ask and provide proof. Even minor upgrades can add up to noticeable savings.

4. Maintain a Good Driving Record & Credit Score: Your Responsibility Pays Dividends

Your personal history, both on the road and financially, is a key indicator for insurance companies when assessing your risk profile. A consistent display of responsibility can significantly influence your premiums.

Your Driving Record (for Auto Insurance): This is arguably the most significant factor in determining your auto insurance premiums.

- Clean History is King: A prolonged history free of accidents (especially at-fault), speeding tickets, and major violations (such as DUIs or reckless driving charges) positions you as a low-risk driver. Insurers highly value safe drivers because they statistically file fewer and less costly claims.

- Impact of Violations: Even minor infractions like a single speeding ticket can cause your premiums to jump. Major violations can lead to dramatic increases or even policy cancellation. The impact can last for several years (typically 3-5 years, depending on the violation and state).

- Defensive Driving Courses: Many states and insurers offer discounts for completing approved defensive driving or accident prevention courses. These courses not only refresh your driving skills but also demonstrate your commitment to safe driving, which can translate into premium reductions, especially for younger drivers or those looking to offset a minor infraction.

Your Credit Score (for Auto & Home Insurance): While it might seem unrelated, your credit history plays a crucial role in determining your insurance premiums in most states (where legally permitted). Insurers use what’s known as an “insurance score,” which is derived from information in your credit report.

- The Link: Studies have shown a correlation between a responsible financial history (reflected in a good credit score) and a lower likelihood of filing insurance claims. Insurers view financially responsible individuals as more likely to be responsible in other aspects of their lives, including maintaining their property and driving habits.

- Factors Influencing Your Insurance Score (similar to FICO):

- Payment History: Paying bills on time.

- Amounts Owed: High debt utilization can negatively impact scores.

- Length of Credit History: Longer histories are generally better.

- New Credit: Opening too many new accounts in a short period.

- Credit Mix: Having a variety of credit types (e.g., credit cards, loans).

- Impact on Premiums: A strong insurance score can lead to noticeably lower premiums for both auto and home insurance, as insurers perceive you as a lower risk.

Actionable Tip: Drive safely and responsibly at all times. Additionally, diligently manage your finances, pay bills on time, and regularly review your credit report for any inaccuracies. Improving your credit score over time can have a ripple effect on your insurance rates.

5. Shop Around & Compare Annually: Your Most Powerful Savings Tool

This is arguably the most critical and often overlooked strategy for saving money on insurance, and it’s precisely where TheBestInsurance.co offers unparalleled value. Insurance rates are anything but static; they are highly dynamic and constantly fluctuate based on a multitude of factors, including market conditions, your evolving personal circumstances, and each insurer’s continuously updated risk assessment models. Relying on an automatic renewal with your current provider can be one of the costliest financial oversights you make.

Why Annual Comparison is Absolutely Vital:

- Market Dynamics and Rate Changes: Insurers frequently adjust their pricing algorithms, underwriting guidelines, and discount offerings. A company that was the cheapest last year might not be this year, and vice versa.

- Your Evolving Profile: Life events significantly impact your rates. Getting married, buying a new car or home, changing your commute, or even reaching a certain age milestone can alter your risk profile, potentially qualifying you for new discounts or different rates.

- Introduction of New Discounts: Insurance providers are always looking for ways to attract new customers. They might introduce new discounts (e.g., for specific professions, low mileage, or new home features) that your current insurer doesn’t offer or hasn’t applied to your existing policy.

- Intense Market Competition: The insurance industry is fiercely competitive. By actively shopping around, you essentially compel multiple insurers to compete for your business, which naturally drives down pricing as they vie for your policy.

- No Loyalty Penalties: While some insurers offer loyalty discounts for long-term customers, these are often outweighed by the savings you can find by switching to a new provider that’s eager to acquire new business and offers more aggressive introductory rates.

TheBestInsurance.co Difference: Effortless Savings at Your Fingertips Our cutting-edge platform is specifically designed to make comparing quotes from multiple top-tier providers fast, free, and incredibly easy. In a matter of minutes, you can input your details once and instantly view personalized quotes side-by-side. This transparent comparison allows you to:

- Identify Lowest Rates: Quickly pinpoint which insurers are offering the most competitive premiums for the coverage you need.

- Compare Coverage Details: Not just price, but also understand the specific benefits, deductibles, and limitations of each policy.

- Make Informed Decisions: Empower yourself with the knowledge to choose the best value, not just the cheapest option.

Actionable Tip: Mark your calendar to compare insurance quotes at least once a year, typically 30-60 days before your current policy is due for renewal. This proactive approach ensures you have ample time to review offers and make a seamless transition if you decide to switch. This minimal effort can yield maximum savings, potentially putting hundreds, or even thousands, of dollars back into your pocket annually.

Unlock Your Savings Potential Today with TheBestInsurance.co!

Taking control of your insurance premiums is a powerful step towards greater financial wellness. By strategically implementing these five smart strategies – from bundling policies and wisely adjusting deductibles to enhancing your property’s security, maintaining impeccable personal records, and, most importantly, regularly shopping around – you can significantly reduce your annual insurance costs without sacrificing essential coverage.

Don’t let inertia or the perceived hassle of comparison shopping cost you money. The tools are available, and the savings are real. Visit TheBestInsurance.co today. Our platform makes it effortless to quickly and easily compare personalized quotes for auto, home, life, renters, business, commercial, and medical insurance from a wide network of trusted providers. Discover how much you can save in just minutes and take the first step towards a more secure and affordable financial future!